Indian metal organizations are probably not going to be truly influenced by the emergency unfurling at Chinese property engineer Evergrande, as per monetary administrations firm Motilal Oswal.

China assumes a significant part in deciding worldwide ware costs, including that of metals. The country’s land area is a significant shopper of steel, so lower interest from the area could send steel costs staggering.

Portions of Indian steelmakers, for example, Tata Steel, Steel Authority of India (SAIL), Jindal Steel and Power and JSW have been on a descending pattern in ongoing meetings as Evergrande cautioned again it could default. The stocks tumbled forcefully last Monday prior to recovering a portion of the decays — yet on Friday, those offers fell over 2%.

The Nifty metal record dropped 3.27% last week.

Ongoing auction in those stocks were more identified with a chilling in certain metal costs, Hemang Jani, head of value methodology for broking and dissemination at Motilal Oswal, told CNBC’s “Street Signs Asia” on Wednesday.

Iron mineral costs have fallen some 54% since May, investigators said. Iron mineral is utilized in steelmaking and interest for steel — particularly from China — will probably influence costs. Spot costs for different metals like copper, lead, and zinc were likewise down for the month as of Wednesday on the London Metal Exchange, as per a report by the Commonwealth Bank of Australia.

“Demand outlook overall remains quite steady and we think that the pricing is something that we will have to watch out, given the Evergrande developments and how serious or how much deeper corrections we can see,” Jani said.

“We continue to be quite positive, we do not view this development as something which will have serious implications for the metal companies in India,” he said.

Jani said the falling costs of Indian steel stocks is “a buying opportunity” into names like SAIL, Jindal Steel and Power, just as non-ferrous metals firms like Hindalco.

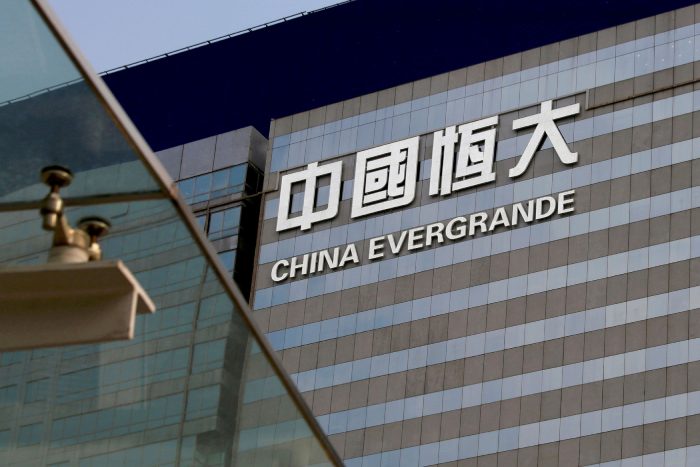

Evergrande is near the precarious edge of breakdown. The obligated Chinese property designer has been scrambling to pay its providers, and cautioned financial backers it could default on its obligations.

China in center

China’s property area had generally made up an enormous part of the country’s product interest, as per the Commonwealth Bank of Australia report, which assessed that property development represented about 25% to 30% of China’s steel interest.

“For now, market attention is firmly tuned to the potential fallout in China’s property sector if China Evergrande defaults on its loans due to a slowdown in property sales,” Vivek Dhar, mining and energy products examiner at the bank, wrote in the report the week before.

However, policymakers in Beijing are likewise hoping to cover the nation’s steel yield during the current year at 2020 levels to diminish outflows, he said. That strategy has caused a decrease in China’s unrefined steel yield for July and August, and that marked down supply prompted an ascent in worldwide steel costs, Dhar added.

While China assumes a significant part with regards to steel evaluating, the area’s development is being driven by a restoration across created markets and India, as per Motilal Oswal’s Jani. “These corrections may not last,” he said, alluding to the Indian steel stocks.

Effect on Indian metal players

In view of the actions China embraced even before the Evergrande issue, the general evaluating climate was “quite good,” Jani said.

“So, let’s wait how exactly this issue pans out, what additional steps the Chinese authorities take, and what sort of pricing impact it could have on the metal stocks,” he added.

India’s metal players possibly have various elements working in support of themselves.

They remember a consistent recuperation for India’s homegrown economy as of late, filled by the public authority arrangements toward public foundation projects. What’s more, with Covid-19 lockdowns being slowly facilitated, assembling and development exercises are additionally getting.

State spending on framework would look good for steel and iron mineral makers in India, as indicated by Jani.

Topics #China #Evergrande crisis #Indian metal firms