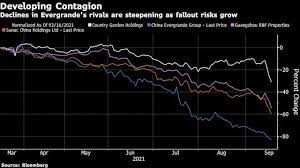

Heightening worry over the effect of a China Evergrande Group default is undulating through the country’s monetary business sectors.

Engineers drove decays on the Hang Seng China Enterprises Index, with Country Garden Holdings Co. – the country’s biggest engineer by deals – losing 7.2% and Sunac China Holdings Ltd. sinking 11%. This week alone the two stocks have fallen over 21%. China’s high return dollar bonds fell however much 4 pennies on the dollar Thursday, as indicated by acknowledge dealers, with those gave by Fantasia Holdings Group Co. – a more vulnerable evaluated engineer – down around a dime.

Yields on China’s garbage notes have move to a 18-month high, as per a Bloomberg record. In Shanghai, bank stocks endured their quickest selloff in seven weeks.

“It’s not just the real estate sector — overall sentiment is quite fragile,” Elizabeth Kwik, Aberdeen Standard Investments Asian values speculation administrator, said on Bloomberg Television.

The viewpoint for Evergrande is breaking down constantly. Evergrande’s coastal unit ended exchanging all bonds on Thursday after a homegrown credit assessor cut its rating. S&P Global Ratings additionally minimized the engineer, saying its liquidity and subsidizing access “are shrinking severely.” Earlier this week, Chinese specialists advised significant moneylenders not to expect a premium installment from the firm due Sept. 20, as indicated by individuals acquainted with the matter. That came after Evergrande employed counsels for what could be one of the country’s biggest ever obligation restructurings.

Financial backers are progressively losing certainty. A few holders of Evergrande’s seaward bonds have as of late picked lawful and monetary agents, Reorg detailed Thursday. One significant investor sold a greater amount of the organization’s stock, a documenting showed.

More extensive indications of stress in the financial framework are less evident. Interbank loaning rates stay close to midpoints, showing adequate liquidity in currency markets. However, a few banks in China seem, by all accounts, to be accumulating yuan at the greatest expense in very nearly four years, a sign they might be planning for what a Mizuho Financial Group Inc. planner called a “liquidity squeeze in crisis mode.”

Bank advances and different borrowings from firms including trusts represented about 81% of Evergrande’s 335.5 billion yuan ($52 billion) of premium bearing obligation coming due in 2021. Top moneylenders incorporate China Minsheng Banking Corp., Agricultural Bank of China Ltd. furthermore, Industrial and Commercial Bank of China Ltd. In an assertion late Monday, Evergrande said reports that it will fail are false.

One week from now will be a litmus test for the organization. Evergrande is planned to make interest installments due Sept. 23 of $83.5 million for a dollar note and 232 million yuan for a neighborhood note, Bloomberg-incorporated information show.

Delicateness in the real estate market – which contains about 28% of China’s economy – is turning out to be more apparent. Information Wednesday showed home deals by esteem drooped 20% in August from a year sooner, the greatest drop since the beginning of the Covid early last year. Reacting to an inquiry on Evergrande’s possible effect on the economy, National Bureau of Statistics representative Fu Linghui said some enormous property endeavors are running into troubles and the aftermath “stays not yet clear.” Economists have cautioned that China is pressing its property market excessively far in its mission to keep away from bubbles.

China’s present needs of advancing normal flourishing and hindering unreasonable danger taking mean there’s probably not going to be any facilitating of controls this year, as per Macquarie Group Ltd. The property area will be a “principle development headwind” for the following year, despite the fact that strategy creators might extricate limitations to safeguard 5% GDP extension, Macquarie examiners wrote in a Wednesday note.

The national bank on Wednesday turned over developing advances to banks instead of adding greater liquidity, a sign that Chinese specialists see no compelling reason to infuse more help into the monetary framework.

The Hang Seng China measure shut down 1.5% on Thursday. Evergrande shares fell 6.4% to the most minimal cost in very nearly 10 years. Portions of Guangzhou R&F Properties Co., another garbage evaluated designer, endured their most exceedingly terrible misfortune since mid 2009. The Shanghai property stock file slid 2.7%.

Topics #Evergrande Market Fallout