Financial literacy is a fundamental aspect of economic empowerment and security, particularly within underserved communities. Yet, despite collective efforts to promote financial education, wealth gaps persist and even widen, showing the need for innovative solutions. Enter Black Banx, a digital banking platform spearheading a revolution in financial services with a mission to empower the unbanked and underbanked and redefine traditional banking norms.

Understanding Financial Literacy

Financial literacy within the underserved community revolves around crucial skills such as budgeting, saving, investing, and debt management. These skills are seen as pathways to achieving various financial goals, including homeownership, education financing, retirement security, and the creation of generational wealth. However, despite the availability of resources and programs, empirical data suggests that wealth disparities persist even in this day and age when digital banking has become quite common.

Investopedia defines financial literacy as the ability to understand and effectively utilize various financial skills for the benefit of oneself. To be financially literate means having a good foundation for a smart relationship with money. Unfortunately, just like quality education, not everyone has access to services that teach and instill lessons on financial literacy. This explains why many people around the world still struggle to achieve financial stability.

Traditional Banking Limitations

Traditional banking systems often impose stringent criteria for accessing financial services, including income, credit score, and employment history. These criteria can be prohibitive for many consumers, particularly those from marginalized backgrounds. As such, people in secluded areas are mostly underbanked and underserved because traditional banks are unlikely to extend their services to them due to geographic limitations.

According to the World Bank, around 2.5 billion people remain unbanked based on the latest statistical data. While a big portion of this is attributed to the limitations of traditional banking, many people also opt out of the financial market due to other reasons, such as the lack of trust and confidence in banks, the absence of financial literacy, and the state of being indigent.

The Rise of Black Banx

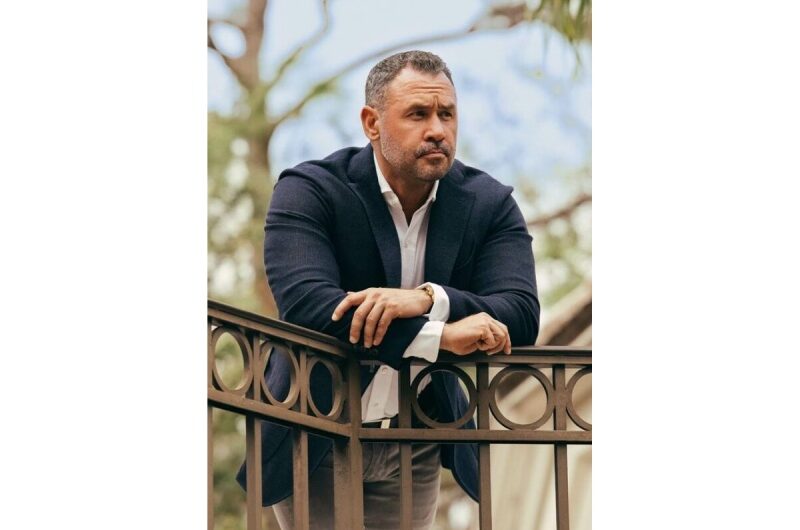

Canada-based digital bank Black Banx is one of the fintech brands pushing for financial inclusion worldwide. Founded by German billionaire and renowned entrepreneur Michael Gastauer in 2015, the company is one of the pioneers in the fintech space today. It operates in 180 countries and territories across the globe, with a focus on serving isolated places and key markets equally.

Black Banx distinguishes itself from other digital banks through its commitment to adaptability and inclusivity. Its digital banking platform provides easy access to essential financial services, including banking, lending, investment, and cryptocurrencies. By integrating digital assets and prioritizing financial education, Black Banx empowers users to make informed decisions about their finances.

Impact on Financial Inclusion

Black Banx’s innovative approach has the potential to bridge the gap in financial inclusion by catering to the needs of historically underserved communities. Its digital nature ensures accessibility, even in regions with limited physical infrastructure, thereby promoting economic stability and upward mobility. It also has an easy sign-up process that only requires one photo ID for verification.

Based on its latest financial report for the first quarter of 2024, Black Banx already serves more than 45 million private and business accounts—a relatively small number but at the same time a significant quantity when taking into account the number of underserved people. It’s also worth noting that the company is seeking to close the year with 75 million total users, proving once again Black Banx’s commitment and impact on financial inclusion.

Addressing Financial Illiteracy

Financial illiteracy remains a pervasive issue globally, with significant implications for individuals and society at large. Black Banx plays a crucial role in addressing this challenge by offering tailored financial guidance, simplified processes, and personalized education resources. Through features like automated savings and budgeting tools, Black Banx empowers users to enhance their financial literacy and make sound financial decisions.

Gastauer and his team of software experts strategically designed Black Banx to be highly intuitive so even first-time users won’t have a hard time using its features and services. Whether its on the website or the mobile app, Black Banx provides step-by-step guides on how to use its platform and access its financial services. The use of artificial intelligence and machine learning technologies also enhance the user experience, so clients can make sound decisions with their finances.

Promoting Financial Inclusion and Security

Black Banx’s commitment to affordability, simplicity, and security makes it an ideal solution for people facing barriers to traditional banking services. By reducing paperwork requirements, offering mobile-friendly services, and prioritizing data security, Black Banx ensures that all users can access its reliable financial services.

Gastauer’s digital bank also continues to innovate and expand its offerings yearly. Using technologies like AI, machine learning, and blockchain, Black Banx aims to provide even more personalized and accessible financial services. Through these advancements, Black Banx not only addresses financial illiteracy but also contributes to broader societal and economic progress.

In sum, Black Banx helps users understand finance by promoting financial literacy and inclusion. By breaking down barriers, empowering users, and leveraging the latest financial technology advancements, Black Banx paves the way for a future where everyone has equal access to financial opportunities, security, and education.

Topics #Black Banx #finance #Financial Literacy