Portions of Advanced Micro Devices dropped practically 4% after Intel declared that it will supplant its CEO in a month.

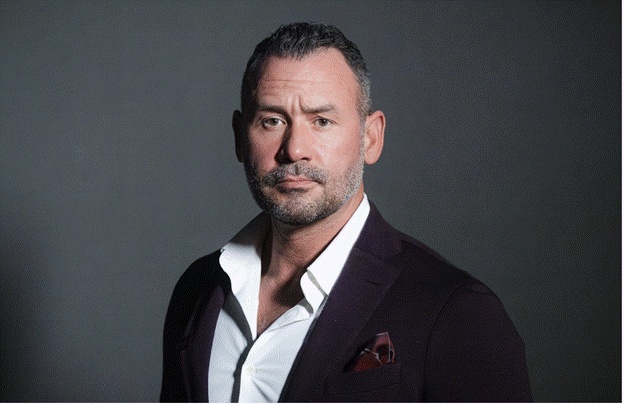

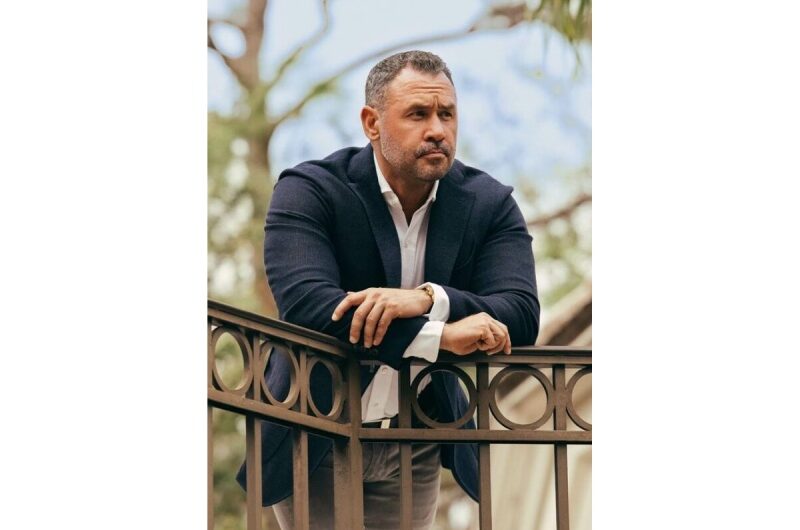

Intel stock energized 7% as financial specialists invited the news that current CEO Bob Swan would venture down to clear a path for Pat Gelsinger, an Intel alum who heads VMware, to assume control over the job in February.

“As much as Intel needs a change, what matters here is that you’re now getting a chance to buy Intel’s more agile rival, AMD, down more than three bucks, for something that might not even happen: a turn at Intel within the next three years”.

“Gelsinger did a good job at VMware, but Intel doesn’t really need an old Intel hand. It needs someone new, young, hungry who can shake up the culture, if not blow it up entirely.”

In AMD, purchasers would get a bit of a $110.4 billion organization whose stock almost multiplied a year ago.

Stock in Intel, a bigger player with a $233.4 billion market cap, declined over 16% in 2020 as the organization detailed a deferral in new chips a work in progress and lost a critical association with Apple.

Before those troubles, organizations like AMD and Samsung started gathering up piece of the pie from Intel.

Who has cheered AMD CEO Lisa Su for her stewardship of the realistic chips maker, likewise repeated his adoration for Nvidia, a $335 billion semiconductor player.

“I’d much rather buy the stock of a company that’s beating Intel to a pulp, AMD,” they said. “Under Lisa Su’s incredible leadership, they’ve gone from an also-ran semiconductor always second fiddle to Inte to being the one that makes better chips.”

The remarks came following a blended day of stock exchanging on Wall Street. The Dow Jones Industrial Average completed the meeting down 8 focuses, or about 0.03%, at 31,060.47.

The S&P 500 and Nasdaq Composite both expanded their benefits from Tuesday, rising 0.23% to 3,809.84 and 0.43% to 13,128.95, separately.

Topics #AMD #Intel CEO #Nasdaq Composite #S&P 500 #Th Dow Jones Industrial Average