Authentic Devices, the Delhi-NCR-based driving Level 1 provider, which timed Rs 600 crore income in FY2923 in its heritage business of auto latches, is looking at expedient income age development from the EV business in India. As a diversification strategy that has paid off, the company began manufacturing 48V motor controller units (MCUs) for electric two- and three-wheelers in the middle of the CY2021.

Having inked an innovation move settlement with China’s Jiangsu GTake Electric Organization, Real Devices set up an auxiliary – Authentic GTake E-Portability – to bring cutting edge EV innovation for its clients in India, and is presently looking at key venture into more EV product offerings. Around 35 engineers are working on product and application engineering at the company’s Bengaluru technology center.

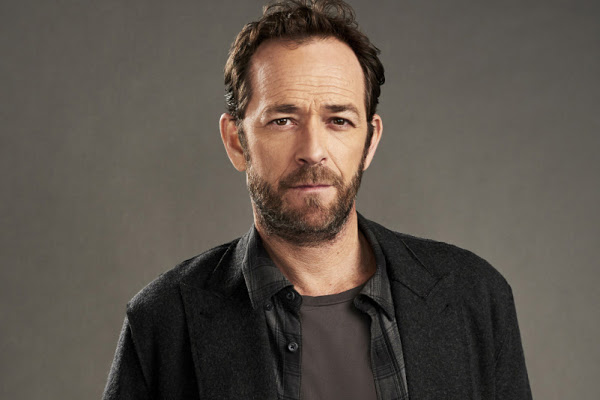

“While our center lies in auto parts and that characterizes the Real Gathering, having been in the latch business for more than forty years, we began arranging our expansion system almost a long time back by assessing the business patterns. Obviously jolt is arising as the most clear future innovation, and we accept we have a spot in the independent, associated, and electric spaces out of the CASE megatrend,” says Jaideep Wadhwa, overseeing chief, Real GTake E-Portability.

“With its connection point with the battery pack, engine, and instrument group, a MCU permits us to assume a key part in the general EV design, and that was one of the fundamental rules while shortlisting the right item,” he added.

Sterling GTake E-Mobility’s supply of EV components from its 300,000-unit capacity plant in Faridabad, Haryana, generated Rs 175 crore in revenue in FY2023. The EV powertrain organization is bullish about future development from the homegrown market, and is embraced limit extension at similar area this financial 48V engine regulator units (MCUs) for electric two-and three-wheelers in mid-CY2021.

In spite of the fact that it is sloping up ability to 600,000 units by end-FY2024, the organization likewise plans to serve more classifications of vehicles inside its current EV product offering of MCUs, and is bullish about the basic development in the light business vehicle (LCV) portion.

“While today our EV business is based on the two-and three-wheeler sections where a great deal of the underlying EV reception is occurring, the LCV classification is a promising space, wherein both laid out players as well as new companies are bringing their items. According to Wadhwa, “We see it becoming more attractive for electrification going forward.”

Strengthening in-house businesses Sterling GTake E-Mobility will spend the same amount of money on capital expenditures in FY24 through cash accruals and term debt, as it has so far invested Rs 28 crore in its EV business. By the end of FY24, the company will have invested approximately Rs 50 crore in engineering and product development, with a significant portion of this investment going there.

As indicated by Atul Aggarwal, entire time chief, Real Instruments, “The EV parts business is a working-capital-concentrated business, and it is likewise weighty on innovation improvement – both equipment, and programming. That requires a lot of our employees as well as financial resources. In order to carry out application engineering and product development, we have our EV technology center in Bengaluru, where approximately 35 engineers are stationed. We expect to develop the headcount to 70 toward the ongoing monetary year’s end.”

The business opened a technology center in Bengaluru last year and plans to grow its capabilities over time. We keep on looking past MCUs, and search for extra open doors inside the EV powertrain space. “We will never be silent recipients of a technology,” Wadhwa asserts. “We are looking at more joint ventures and technology collaborations.”

In order to create new products, we need our own capabilities. That is where our in-house capacities will become possibly the most important factor, and will empower us to foster more India-explicit arrangements,” adds Wadhwa.

Sterling GTake E-Mobility is currently focusing on the Indian market, which it believes has a lot of activity going on, despite the fact that its agreement with Jiangsu GTake Electric Company permits it to conduct component exports from India. Wadhwa asserts, “We will be happy to explore opportunities for export in the future, but not at the expense of neglecting our domestic customers.”

“Over the long haul, our point is to develop our heritage business naturally, and make steady limit extensions. Capex of Rs 25 crore is already planned for FY2024. Going ahead, we will likewise add corresponding product offerings in our clasp business that will enhance our incomes. We are zeroing in on our new organizations – EV powertrains and supply chains for new-energy vehicles – which are our center regions for the main part of the development later on,” finishes up Aggarwal.

Topics #Auto Latches #Bengaluru Technology Center #Delhi-NCR #New-Energy Vehicles #Sterling Tools #Supply Chains